現在参加者の数: 9568

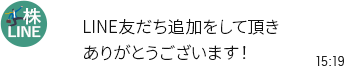

LINE友だち追加で

大本命の急騰銘柄を今すぐ入手可能

- ※ボタンをクリックするとLINE友だち追加画面に進みます。

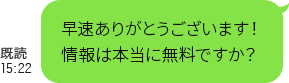

- ※完全無料0円のLINEサービスのためご料金の発生は一切ありません。

01

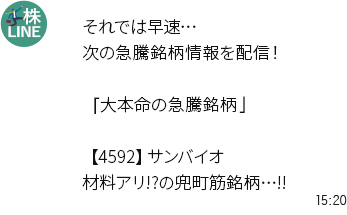

今すぐあなたのLINEに

急騰銘柄情報が

完全無料で届きます!

02

LINE配信される

株式投資情報をご活用頂くことで

1000万円を超える利益を

手にされる方も続出しています!

アナリスト評価が高い銘柄!

アナリストレーティングが高い、直近のPV数が多い、目標株価との乖離幅が大きい銘柄をランキング

買い予想・ PVランキングはこちら▼

将来性あり!

直近の業績が好調で、将来性があり、株価上昇にも期待ができる銘柄を抽出

成長期待株はこちら▼

出来高の多い上位100銘柄!

LINE証券で取扱う銘柄のうち、出来高の多い上位100銘柄を表示

出来高ランキングはこちら▼

-

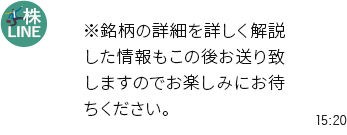

株式投資に関するご相談・当LINEサービスへのご質問など、ご不明点がございましたらお気軽にLINEでご連絡ください!

お問い合わせはこちら

-

LINE友だち追加で

大本命の急騰銘柄を今すぐ入手可能

- ※ボタンをクリックするとLINE友だち追加画面に進みます。

- ※完全無料0円のLINEサービスのためご料金の発生は一切ありません。